Clinical data registries are useful across many parts of healthcare. One of their most valuable purposes is post-market surveillance.

Registries are designed to collect, analyze, and interpret large amounts of real-world data setting the foundation for successful post-market surveillance. When registries are built well, the result is a vast data resource that provides real-time, ongoing data collection, and is a central source of truth to answer key questions like:

- How is a device or drug actually used in real-world settings?

- What does the typical target patient look like?

- How does a product truly perform for the target patient population versus sub-populations that differ by age, gender, race/ ethnicity, geography and combination of comorbidities?

Let’s dig into how registries are used in post-market surveillance, starting with some key definitions.

In this post we will cover:

- What Is Post-Market Surveillance?

- What Are the Goals of Post-Market Surveillance?

- What Is the Value of Post-Market Surveillance?

- How Do You Conduct Post-Market Surveillance?

- How Do Clinical Registries Drive Post-Market Surveillance?

What Is Post-Market Surveillance?

Post-market surveillance (also called post-marketing surveillance) demonstrates the real-world safety and effectiveness of medical devices and pharmaceuticals.

The U.S. Food and Drug Administration (U.S. FDA) defines it as “the active, systematic, scientifically valid collection, analysis, and interpretation of data or other information about a marketed device.” [1]

This definition underscores that post-market surveillance is an active, ongoing process – not a one-off. It also emphasizes data science as a critical part.

The European Medical Device Regulation (E.U. MDR) defines it as “all activities carried out by manufacturers in cooperation with other economic operators to institute and keep up to date a systematic procedure to proactively collect and review experience gained from devices they place on the market, make available on the market or put into service for the purpose of identifying any need to immediately apply any necessary corrective or preventive actions.”

Similar to the U.S. FDA, the EU MDR also highlights the need for a post-market surveillance system that provides up-to-date insights. But it goes a step further to call out the importance of using those insights to make adjustments and improvements.

What Are the Goals of Post-Market Surveillance?

Pharma and medical device companies rely on the real-world insights they gain through post-market surveillance activities to:

- Detect adverse events or risks as they arise during real-world usage of a device or drug.

- Compare new products or treatments with existing options and the standard of care.

- Update clinical guidelines as certain populations or groups find more benefit than others.

- Comply with regulatory requirements.

There are many different aspects of a device or product that are assessed in post-market surveillance. A few examples include:

- Clinical effectiveness: Use data from real-world clinical settings to examine the relative effectiveness of a device or drug in a large, diverse patient group to compare that product to the standard of care or competition.

- Adverse events and side effects: Leverage real-world evidence to identify risks or adverse reactions that might have been missed in the initial clinical trial for a device or drug.

- Utilization: Examine how a product is actually used in the real world, which can be different than what is approved or marketed.

What Is the Value of Post-Market Surveillance?

Real-world evidence delivered through post-market surveillance offers differing importance for different stakeholders.

For medical device companies and pharmaceutical companies, post-market surveillance can provide additional information on the natural history of disease and the relative performance of their product to the disease, as well as other marketed products. The veracity of evidence acquired through an appropriately designed registry or post-market surveillance program enables the sponsoring company to then tweak clinical, marketing and pricing strategies accordingly to develop new and improved patient-centric products.

For clinicians and provider organizations, post-market surveillance can provide information on how products perform relative to others in the context of real-world patient populations, which are often materially different from clinical trial populations. This can then inform treatment decisions, including off-label use of products.

For payers and regulatory agencies, post-market surveillance can shed light on which products and drugs are the safest and most cost-effective. This can then inform coverage and reimbursement decisions.

How Do You Conduct Post-Market Surveillance?

Let’s break down the U.S. FDA’s definition of post-market surveillance into three components:

- Data Collection

- Data Analysis

- Data Interpretation

These are the steps to conducting post-market surveillance for medical devices and drugs.

Step 1: Data Collection for Post-Marketing Surveillance

You need the right data sources and the right technology to collect real-world data efficiently, securely, and accurately for post-market surveillance activities.

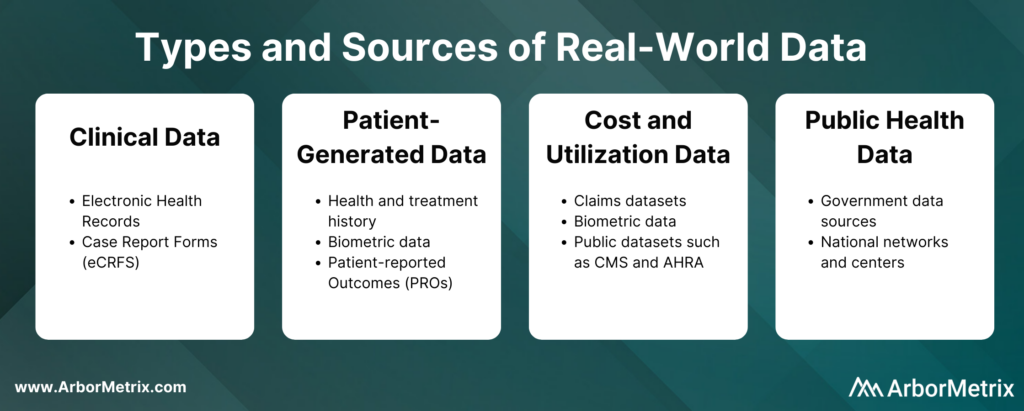

These real-world data can come from several sources, such as:

- Clinical data from electronic health records (EHRs) and case report forms (eCRFs)

- Patient-generated data from patient-reported outcome (PRO) surveys

- Cost and utilization data from claims and public datasets

- Public health data from various government data sources

These real-world data are collected in two primary ways:

- Machine-to-machine data connection allows you to securely and efficiently collect real-time data from any number of systems, including electronic health records and administrative claims.

- Human-to-machine data collection allows you to capture essential care details and specialized information with electronic case report forms. It also allows you to collect patient-reported outcomes (PROs) or gain insights directly from patients, clinicians, and others through web-based surveys.

The technology you use to get this data matters. You need an efficient and secure way to collect large amounts of real-world data and prepare it for analysis.

Step 2: Data Analysis for Post-Marketing Surveillance

Once you collect data for a given device or product, the next step is transforming it into real-world evidence. This involves combining, blending, validating, and analyzing various data sources. These analyses can be risk- and reliability-adjusted according to the data ingested, and then presented to stakeholders in an interactive and engaging way.

Step 3: Data Interpretation for Post-Marketing Surveillance

Once you are finished collecting and analyzing data, you need a way to interpret the data easily and readily. Here are a few things to keep in mind:

- To ensure timely and accurate interpretation of data, you need statistically-adjusted reports that are available in real-time. This helps you quickly and easily measure and understand clinical outcomes, determine patient quality of life, and understand the total financial impact of the intervention.

- Statistically-adjusted reports should be built using key risk and reliability adjustment methodologies that are essential to success in maximizing data value.

How Do Clinical Registries Drive and Use Post-Market Surveillance?

Clinical data registries are uniquely useful in their ability to facilitate post-market surveillance for three reasons.

- They advance post-market surveillance activities to help us better understand the real-world safety and effectiveness of procedures, treatments, and devices.

- They solve complex problems for device and pharma companies. These organizations in general are faced with complex barriers when seeking real-world data for purposes of research and development, quality improvement, or regulatory requirements.

- They deliver the comprehensive technology needed to build a registry that collects real-world data, transforms it into real-world evidence, and makes it accessible and useful for decision making.

There are a few ways medical device and pharmaceutical companies are using registries to support their post-market surveillance programs.

- Accessing data from an existing registry.

- Partnering with an existing registry that is running registry-based clinical trials.

- Leveraging registry technology to support a registry-based study.

- Creating new registries and using existing registry data to support a full post-market surveillance program.

Industry-Leading Registry Technology for Post-Market Surveillance

As medical technology and research continues to advance, the importance of tracking and reacting to real-world evidence through post-market surveillance will only continue to grow. Registries will play an integral part in this process, and their analytic potential will serve as an essential asset for patients, providers, and industry partners alike.

ArborMetrix offers an industry-leading, proven registry solution for post-market surveillance that meets the needs of medical device manufacturers, pharmaceutical companies, medical specialty societies, and clinicians.